Overview

In Mexico’s fast-moving consumer goods landscape, small and mid-sized CPG brands often find themselves at a disadvantage. While large companies have access to advanced data platforms like Nielsen and Meta to inform their marketing and product strategies, smaller brands are left navigating decisions without the same level of insight or resources.

At the same time, shoppers especially those managing household budgets face a disjointed experience when it comes to finding and benefiting from brand promotions across different retailers.

This project set out to bridge both sides of that gap.

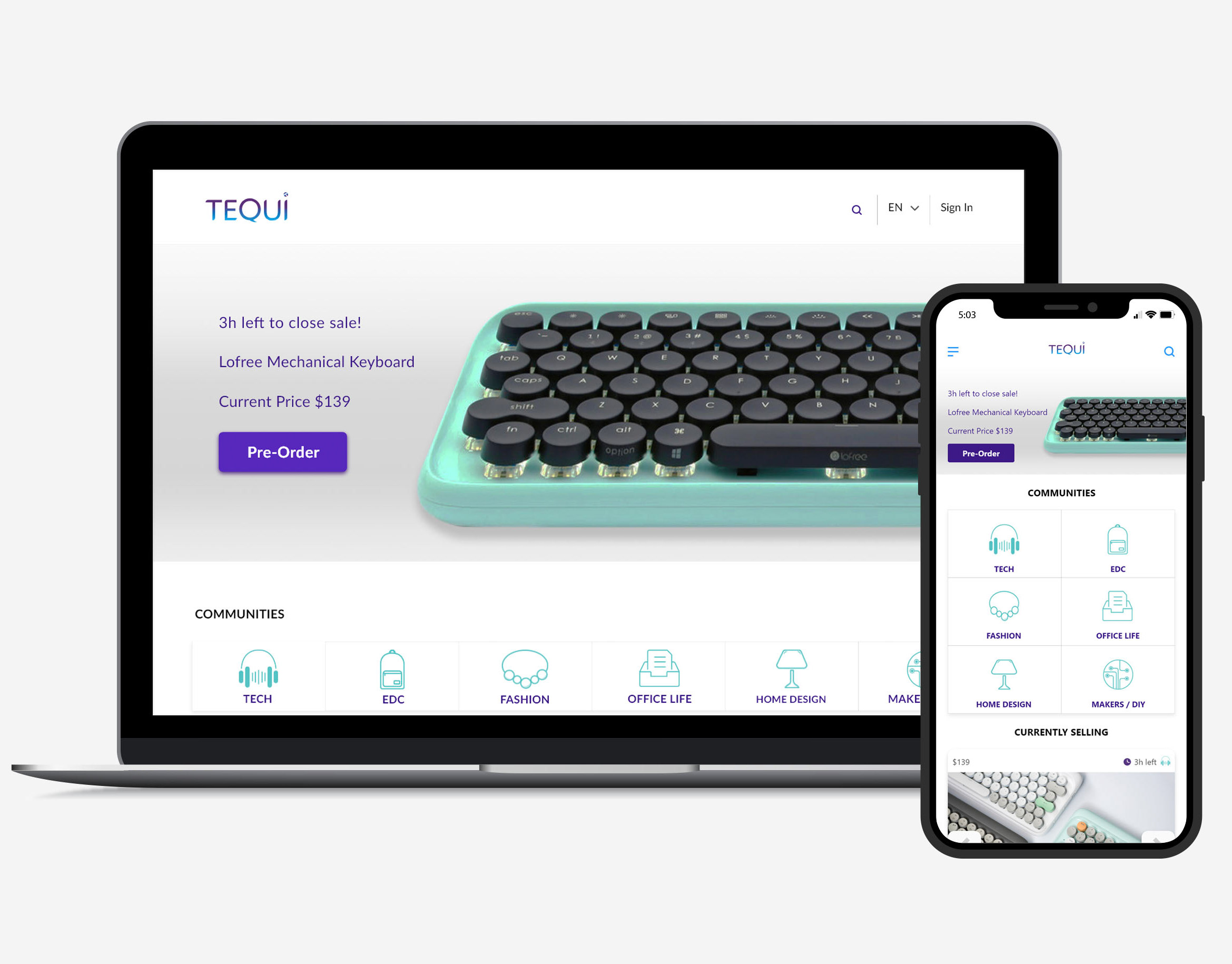

We created Snap Rewards and Snap Insights, two interconnected, AI-powered products designed to work in harmony.

Snap Rewards offers everyday consumers a simple way to earn rewards from participating brands just by uploading their receipts, no signups, codes, or loyalty cards required.

Snap Insights gives CPG brands real-time access to consumer data and promotional performance, helping them better understand shopper behavior and build smarter campaigns across retail partners.

Together, these platforms form a unified ecosystem: consumers benefit from meaningful savings, while brands gain the visibility they need to grow without the barriers of traditional data systems.

My Role

Lead UX designer responsible for:

• Leading the UX vision and strategy from discovery to delivery

• Leading research and translate insights into actionable design decisions

• Defining core user flows and wireframes for key features

• Collaborating closely with product managers, engineers, and business stakeholders

• Establishing a design system and UX guidelines to support consistency as the product scaled

• Driving iterative usability testing to refine the platforms

The Challenge

Smaller CPG brands in Mexico lacked affordable tools to gather real time customer insights, making it difficult for them to compete with larger players.

Meanwhile, everyday consumers, especially working professionals responsible for household shopping, struggled to discover brand promotions or earn rewards across different retailers.

Meanwhile, everyday consumers, especially working professionals responsible for household shopping, struggled to discover brand promotions or earn rewards across different retailers.

Key Problems:

- No centralized third-party platform for brands to analyze cross-retailer consumer behavior

- Consumers often unaware of brand-driven promotions or miss out on loyalty rewards

- Complex data tools and fragmented touchpoints create friction for both brands and shoppers

Starting Point

Before diving into solutions, I knew I needed to start with deep listening. I set out to uncover what really stood in the way for small to mid-sized CPG brands when trying to run promotions and understand their consumers.

Without access to expensive research tools or in house analysts, many brands were forced to make decisions based on instinct rather than data.

My goal was to pinpoint their true needs: simple, actionable, affordable insights, not another complicated dashboard.

My goal was to pinpoint their true needs: simple, actionable, affordable insights, not another complicated dashboard.

To ground the platform in real-world challenges, I conducted 6 user interviews and contextual inquiries with founders, marketing leads, and sales managers across emerging food, beverage, and personal care brands in Mexico.

Research findings

1. Fragmented Processes:

Brands were managing promotions manually through emails, Excel sheets, and WhatsApp groups, lacking any centralized system to track performance.

Brands were managing promotions manually through emails, Excel sheets, and WhatsApp groups, lacking any centralized system to track performance.

2. Blind Spots in Consumer Behavior:

Despite running promotions, brands rarely had access to real-time purchase behavior or demographic data beyond limited retailer reports.

Despite running promotions, brands rarely had access to real-time purchase behavior or demographic data beyond limited retailer reports.

3. Limited Technical Resources:

Most small teams lacked dedicated marketing analysts or IT support, making complex tools difficult to adopt.

Most small teams lacked dedicated marketing analysts or IT support, making complex tools difficult to adopt.

4. Cost Sensitivity:

Existing solutions like Nielsen or CRM systems were prohibitively expensive, forcing teams to rely on guesswork.

Existing solutions like Nielsen or CRM systems were prohibitively expensive, forcing teams to rely on guesswork.

5. Desire for Simplicity:

Users wanted intuitive, mobile-accessible platforms that required little to no setup or technical expertise.

Users wanted intuitive, mobile-accessible platforms that required little to no setup or technical expertise.

Voices behind the journey

As I listened to the people behind these smaller brands, clear patterns started to emerge. To keep their stories front and center, I created three key personas that captured their goals, struggles, and what they truly needed. From there, I mapped how they actually searched for insights, tracked promotions, and made sense of shopper data. That’s where the messy moments and the real opportunities for Snap Rewards and Snap Insights began to reveal themselves.